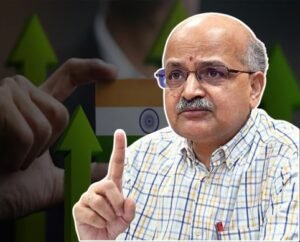

India should adopt a single direct tax system rather than maintaining two separate regimes: Revenue Secretary

The Secretary of the Department of Revenue, Ministry of Finance, Sanjay Malhotra, stated that India should have a single personal income tax regime rather than two. He pointed out that a sizable 70% of taxpayers have already chosen the new tax system, indicating a definite shift in favor of the more straightforward new tax structure.

During the post-budget session at the PHD House of Commerce and Industry, Malhotra stated, “We should have a single direct tax regime instead of two, the new and the old.”

In India, there are two income tax regimes available to taxpayers: the old regime gives many deductions and exemptions but has higher tax rates; the new regime has lower tax rates but fewer deductions.

Regarding the extensive review of the Income Tax Act announced in the Union Budget, Malhotra stated, “It’s a monumental task. The Income Tax Act spans 1,600 pages, making it a significant challenge. The goal of the review is to eliminate exceptions and outdated provisions.

Malhotra also noted that the real estate sector in India experienced a slight increase in the long-term capital gains (LTCG) tax rate to 12.5 percent, compared to the effective tax rate of 11.54 percent for 2022–23.

The Union Budget removed the LTCG’s indexation advantages for residential properties. The majority of property owners, particularly those who kept their properties for extended periods, may have had their tax burden increased as a result of this shift, and the LTCG tax rate decreased from 20% to 12.5%. Tax simplification and the elimination of the tax disparity between capital gains from real estate and other assets were the goals of this action.

Malhotra discussed the higher capital gains tax in the 2024 Budget, saying: “We studied 10.5 lakh returns from 2022–2023 that included capital gains from land and buildings. The effective real estate tax rate was 11.54 percent in 2022–2023 (less than the tax on salaries).” There has only been a tiny real estate LTCG tax rise.”

Malhotra added, “We are experiencing significant growth in tax revenues, which are increasing by 40 percent more than GDP. This rise in tax buoyancy is attributed to improved tax compliance. The budget aims to achieve ‘Viksit Bharat’ by 2047 by simplifying tax provisions and reducing disputes. Conducting a comprehensive review of the 1,600-page Income Tax Act is a substantial challenge to eliminate exceptions and outdated provisions.”