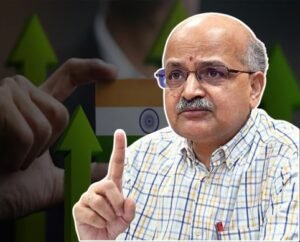

Trade Minister Piyush Goyal stated that India is not reconsidering its stance on allowing Chinese investment

Commerce and Industry Minister Piyush Goyal stated on Tuesday that India is not reconsidering its position on supporting foreign direct investments (FDI) from China, despite recent suggestions made in the Economic Survey.

He claimed that the report consistently discussed novel concepts and shared its original research.

He clarified that the government is under no obligation to implement the survey and that encouraging Chinese investments in the nation is not a consideration.

The minister informed reporters that “there is no rethinking to support Chinese investments in the country at this time.”

2020 saw the government impose restrictions on foreign direct investment (FDI) from nations that border India on a landed border.

Afghanistan, Bangladesh, Bhutan, Nepal, Myanmar, and China are among the nations that border India on land.

The minister was reacting to an argument put up on July 22 by the pre-budget Economic Survey to look to China for FDI to increase domestic manufacturing and expand into export markets.

The survey suggested that with the US and Europe moving their immediate sourcing away from China, it would be more effective for Chinese companies to invest in India and export products to these regions rather than importing from China.

India might choose to participate in China’s supply chain or encourage foreign direct investment (FDI) from China to capitalize on the ‘China plus one approach’.

“Of these options, concentrating on Chinese FDI appears to be more likely to increase India’s exports to the US, much like East Asian economies have done in the past. Furthermore, it seems more profitable to use FDI rather than trade as a strategy to profit from the China plus one approach. This is a result of the widening trade gap between China and India, which is the latter’s principal import partner,” the report continued.

China comes in at number 22, accounting for just 0.37 percent (or USD 2.5 billion) of the total FDI equity inflow that India reported between April 2000 and March 2024.

Following the violent confrontation in the Galwan Valley in June 2020—the most significant military conflict between the two sides in decades—the relationship between the two countries took a heavy hit.

Although the two sides have disengaged from several places of conflict, the Indian and Chinese forces have been engaged in a standoff since May 2020, and the border dispute has not yet been fully resolved.

India has insisted that, unless there is peace in the border regions, its relations with China cannot return to normal.

In response to increasing tensions, more than 200 Chinese smartphone apps, including WeChat, TikTok, and Alibaba’s UC browser, have been blocked in India. The nation has also turned down a sizable investment request from BYD, a manufacturer of electric vehicles.

But earlier this year, JSW Group’s proposed purchase of a 38% share in MG Motor India Pvt. Ltd. was approved by the Competition Commission of India (CCI).

SAIC Motor, which has its headquarters in Shanghai, owns all of MG Motor India.

India and China’s trade is expanding.

Even though China has not invested much in India, the two countries’ bilateral trade has increased significantly.

China has surpassed the US to become India’s biggest trading partner, with two-way trade valued at USD 118.4 billion in 2023–2024. In the most recent fiscal year, India’s exports to China increased by 8.7% to USD 16.67 billion.

The primary industries with robust growth in exports to that nation include iron ore, plastic, linoleum, spices, cotton yarn, fabrics, and made-ups, handloom products, fruits and vegetables, and spices.

The neighboring nation’s imports rose 3.24 percent to USD 101.7 billion. From USD 83.2 billion in 2022–2023 to USD 85 billion in the most recent fiscal year, the trade deficit increased.

Data from the Commerce Ministry indicates that China ranked as India’s biggest trading partner in 2020–21 and from 2013–14 to 2017–18. The UAE was the nation’s top trading partner before China. In both 2022–2023 and 2022–2023, the US constituted the largest partner.

India may relax restrictions on a few Chinese investments:

According to two government officials who spoke with Reuters last week, India is poised to loosen limits on Chinese investment in non-sensitive industries like solar panels and battery manufacture, where New Delhi lacks experience and promotes local manufacturing.

One official, who preferred to remain anonymous, indicated that the government plans to remove certain sectors from government scrutiny for Chinese investment, provided they are considered less sensitive from a security standpoint.

Restrictions on Chinese investments in industries including telecom and electronics will persist, the government official told Reuters.